How many times have you browsed through an online shopping store, and filled up your cart with things you wanted to buy but abandoned it afterward?

There are so many things out there that we wish and have the desire to buy. But we all have had to make sacrifices or compromises when it comes to buying because we couldn’t afford to pay at the given moment.

Yes, online buyers can purchase all those things with their credit card, however, the additional cost associated with them scares visitors away. These are the concerns that your customers are having when they leave your website without making a purchase.

So, is there any way customers are able to purchase all the things in the cart without being scared of the hefty bill at the end? Yes, thanks to the buy now pay later (bnpl) system, visitors can make all their purchases without worry.

In this article, based on our video below, we will go through how b2b and b2c eCommerce businesses can benefit from the BNPL payment system.

What is Buy Now Pay Later (BNPL)?

Buy Now, Pay Later (BNPL), the newest payment option, is revolutionizing the way people shop. BNPL is a kind of short financing that allows customers to buy goods now and pay for them later, generally without incurring interest. BNPL arrangements, sometimes known as “point of sale instalment loans,” are becoming a more popular payment alternative, notably when shopping online.

How Does BNPL Work?

Buy now pay later systems are not all the same. Each company that provides BNPL service has its own set of terms and conditions, but in general, point-of-sale instalment loans work like this:

- Customers go to a participating shop and choose the buy now pay later option at the checkout.

- If authorized (which happens in seconds), customers then put down a small deposit, such as 25% of the total purchase price.

- The remaining balance is then paid in a series of interest-free instalments.

- Customers can choose the payment method they prefer. These payments can be made by cheque or bank transfer; payments can also be automatically deducted from your debit card, bank account, or credit card.

Interest and fees are rarely charged under BNPL services. They do, however, have a set repayment period, which is usually multiple weeks or months. Customers are told ahead of time how much they’ll have to pay each time, and the amount is usually fixed.

Want to know more tips on how to optimize the checkout process?

Read our article on 8 checkout optimization techniques and decrease your cart abandonment rates.

Buy Now Pay Later vs Credit Card: What Is the Difference?

You may be wondering why you should use a BNPL solution when you can just add financing to your website. Fact is, they are a lot different than you might think.

- BNPL services do not demand a hard credit card check.

- They do not charge interest if clients pay within the predefined terms

- Additionally, BNPL offers a payment frequency that is convenient for customers.

Customers are worried to shop using credit cards and rightfully so. Interest costs on a credit card can quickly mount up, and late payments can harm your credit score.

This makes customers more willing to try BNPL services, particularly when it comes to Gen Z and Millenials, who are finally adults with money to spend. If your target market fits into one of these groups, it’s a good indication that you should use BNPL for your eCommerce business.

Most importantly, buy now pay later users are comfortable with and trust such solutions.

What Is Buy Now Pay Later for eCommerce?

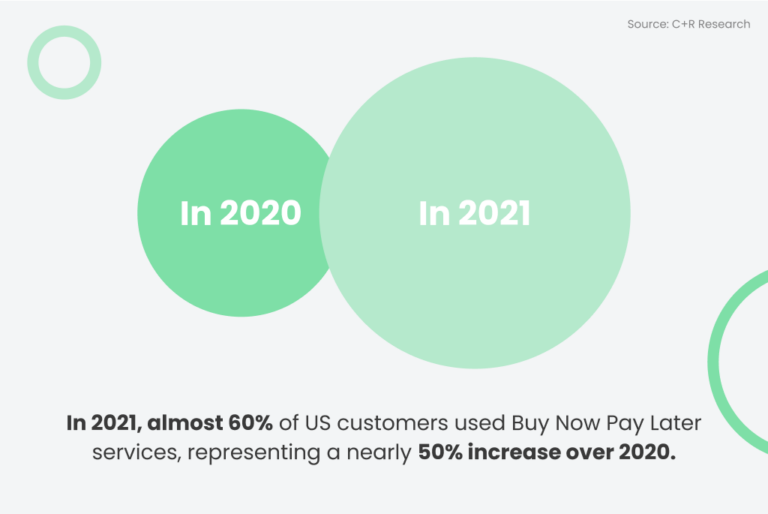

Buy now pay later, or ‘BNPL,’ has emerged into the eCommerce landscape in recent years, and its reach has increased since then. BNPL users can buy things in instalments or pay the fee at a later date using BNPL services, with no additional fees and usually no interest rate.

Additionally, the coronavirus epidemic has expedited the rise of the eCommerce business, which has increased the demand for simple online financing choices. The growth in eCommerce boosted the reach of BNPL suppliers because of consumers switching to buy products online that they normally would buy offline.

Millions of consumers were left jobless and financially unstable as a result of the pandemic, and they needed more purchasing flexibility. However, many people paid off debt during the financial crisis, making interest-free BNPL solutions a more appealing option than piling up another huge credit card amount.

Buy now pay later finance system has drastically stimulated b2b and b2c eCommerce. Retailers can purchase products for their business and pay for them conveniently.

Why Use Buy Now Pay Later in eCommerce Business?

So, now that we have covered the benefits for customers, what are the advantages for a business?

BNPL allows you to avoid the most frustrating situations in eCommerce; when you’ve done everything to get potential customers to your store and convinced them to add some products to the shopping cart but lost them at the last step of the customer journey.

The data shows that as of today, almost 70% of carts are abandoned by potential customers. And cart abandonment is attributed to a lack of preferred payment options by around 35% of customers. Implementation of a Buy Now Pays Later option will help you solve this and a number of other challenges. This will increase the overall sales of the business.

- Competitive Edge

According to recent reports, such payment methods will become more common. Amazon launched a similar feature at the end of August, and Apple is working on a similar solution for its company. It appears that other eCommerce businesses will follow the same BNPL trend. The number of BNPL payment transactions is expected to reach $680 billion by 2025. Implementation will provide you with a competitive advantage over your adversaries.

- Conversion rate improvement

Furthermore, the BNPL business model is known to increase conversion rates and sales. 85% of customers are more likely to make a purchase if a seller offers interest-free payment options. It even has the potential to increase average cart sizes by 20 to 30 percent.

Find out how you can boost your eCommerce sales with strategies that have proved their efficiency.

- Improve customer relationship

All eCommerce stores online struggle to develop trust and gain customer loyalty. It’s something that you can spend years building and not achieving the required result. Turns out, BNPL can become your secret weapon. Around 28% of customers are more likely to buy from merchants again if they offer the BNPL option. Along with customer loyalty, you get a higher customer lifetime value.

One of the reasons why customers don’t make a purchase is because they don’t have money for it. Especially during the pandemic when a lot of people were let go from their jobs. Such customers, without a BNPL, would just leave your store. With such a payment system, especially when shopping for some necessities, they will choose your website over the competition. Online grocery stores will greatly benefit from BNPL services.

Buy Now Pay Later Market Overview

The B2B and B2C eCommerce industry is modernized by BNPL straightforward solutions that provide customers with more flexible payment choices compared to traditional payment methods.

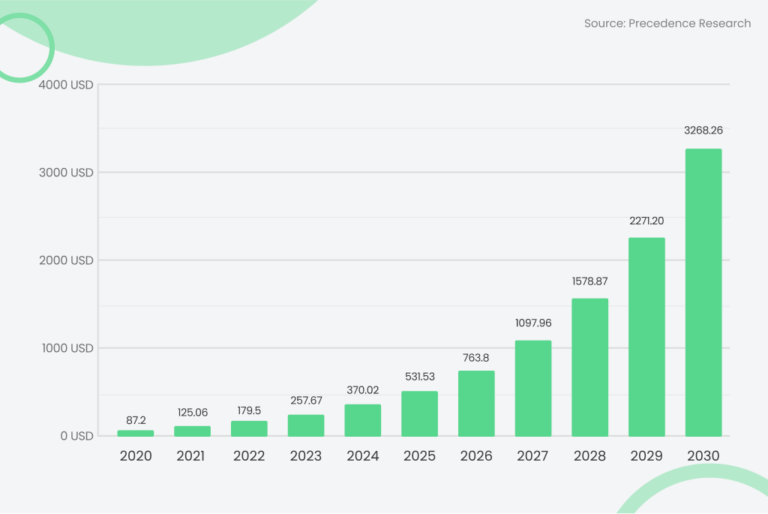

Precedence Research estimates that the global buy now pay later market peaked at USD 125.09 billion in 2021. People can use buy now pay later to make purchases online and in stores without having to pay in full right away. As customers become more aware of instalment-based payment options, the buy now pay later market is likely to grow even more. In addition, the absence of interest fees charged by buy now pay later is expected to further increase the market’s growth potential.

The buy now pay later finance method offers a number of advantages, including affordable and convenient payment services, fast credit card fund transfer at the point of sale (POS) platform, and greater personal information security, all of which contribute to the market’s growth.

Reasons Behind BNPL Boom

What shaped this buy now pay later boom? A number of things are at play:

- For starters, people like BNPL services because they provide a handy way to pay for things over time.

- Second, the BNPL businesses profit from a healthy economy. More people are open to the comforts and conveniences that BNPL services offer, thanks to low unemployment and increasing consumer expenditure.

- Finally, BNPL businesses are profiting from growing eCommerce’s popularity. As more people shop online, they’re seeking ways to acquire things without having to pay in advance. The BNPL services make it simple to do so.

Buy Now Pay Later Business Model for Providers

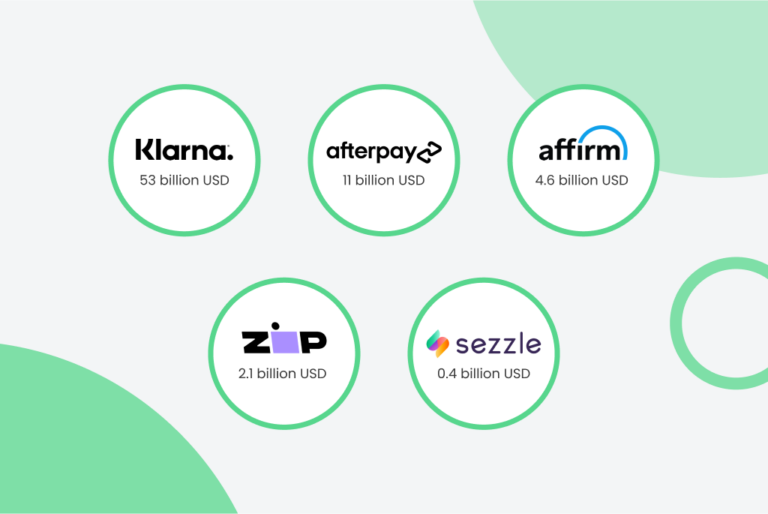

There are several BNPL companies, although some are significantly more well-known than others. The biggest buy now pay later businesses by transaction volume, according to corporate data sources compiled by Statista, are Klarna, Afterpay, Affirm, Zip, and Sezzle.

With $53 billion in GMV (gross merchandise volume), Klarna is by far the biggest of these companies. With $11 billion in GMV, Afterpay is a distant second. Affirm has a GMV of $4.6 billion, Zip has a GMV of $2.1 billion, and Sezzle has a GMV of $400 million.

There is a vast tail of BNPL suppliers with substantially lower gross merchandise volume estimates, with well over 50 on the market.

One of the reasons Klarna is so much bigger than the competition is that it was one of the first to offer a solid BNPL solution with discreet credit checks done in the backend, allowing customers to spend right immediately without incurring interest. They’ve also deliberately expanded and worked with over 100,000 merchants, and they provide top-rated software that is user-friendly for both customers and merchants.

It will be fascinating to witness how these businesses compete in the years ahead. They’re all likely to experience ongoing growth as buy now pay later becomes more popular.

BNPL Companies & Providers List

Here is a list of companies from different regions that provide BNPL services to eCommerce stores:

- Affirm

- Afterpay

- Alliance Data

- American Express

- Chase

- Citi

- Klarna

- Mastercard

- JPMorgan Chase

- PayPal

- Quadpay

- Sezzle

- Shopify

- Splitit

- Stripe

- TSYS

- Visa

- Zip

How to Integrate eCommerce BNPL Options into Your Business

You will need to contact the BNPL service provider in your region If you want to acquire BNPL options at checkout for your own business. Most buy now pay later finance system providers require you to contact them via their website. You will be required to complete forms that detail the countries in which you operate, your annual sales, and your basic contact information. Enquiring BNPL choices is straightforward and quick, allowing you to compare the benefits and drawbacks of numerous providers before signing to one, or several, solutions.

How to Integrate BNPL with Magento

There are numerous solutions on the market that allow adding BNPL functionality to an eCommerce website without a long development process. Magento eCommerce platform is ideal for BNPL. Klarna, Afterpay, Affirm, and many others have modules designed specifically for Magento 2.

Magento eCommerce stores can integrate BNPL with ease and in a considerably short amount of time.

Want to know the main reasons why businesses choose Magento?

Read our article on best reasons for Magento eCommerce development and find out why you should choose Magento to build an eCommerce store

Final Thoughts: What BNPL Means for eCommerce

BNPL, a relatively new means of payment, is having a significant impact on eCommerce. Adidas, Urban Outfitters, BestBuy, and Walmart are just a few of the major brands that are already providing BNPL at checkout. As a result, the BNPL cannot and should not be overlooked. It may not be the best option for every eCommerce shop, but staying up to date with the payment methods shoppers prefer is critical to meeting their demands and increasing sales. BNPL is likely to grow in importance in the context of eCommerce, therefore keeping an eye on it could be useful to many eCommerce businesses.